colorado springs sales tax rate 2021

The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is. The County sales tax rate is.

Sales Tax Campus Controller S Office University Of Colorado Boulder

For tax rates in other cities see colorado sales taxes by city and county.

. The County sales tax rate is. Exact tax amount may vary for different items. The Colorado sales tax rate is currently.

This is the total of state and county sales tax rates. In November of 2019 voters in Colorado Springs passed Issue 2C2 agreeing to continue investment in our roads for years 2021-2025 at a sales tax rate of 057 reduced from 062 for Issue 2C that was passed by voters in November 2015 for years 2016-2020. For Filing Period Ended February 28.

307 Sales and Use Tax Return in Spanish. Use the tax return below for purchases on or after the effective date. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Effective January 1 2021 the city tax rate has decreased to 307 for all transactions occurring on or after that date. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. 307 Sales and Use Tax Return.

The Colorado Springs Sales Tax is collected by the merchant on all qualifying sales made within Colorado Springs. This system will greatly improve our businesss experience by allowing businesses to file and pay taxes at any time via an internet connected device view their account history on demand and delegate access to tax. The Glenwood Springs sales tax rate is 37.

With local taxes the total sales tax rate is between 2900 and 11200. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. Instructions for City of Colorado Springs Sales andor Use Tax Return.

6 rows The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. 2022 Colorado state sales tax.

This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates. Groceries and prescription drugs are exempt from the Colorado sales tax.

31 rows The state sales tax rate in Colorado is 2900. The december 2020 total local sales tax rate was also 6900. The local sales tax rate in colorado springs colorado is 82 as of november 2021.

3 Cap of 200 per month on service fee. The combined amount is 820 broken out as follows. 4 Sales tax on food liquor for immediate consumption.

Colorado has state sales tax of 29 and. The 057 road repair maintenance and improvements tax will expire five years from the date of implementation and will apply to all transactions that are currently taxable under the City Sales and Use Tax Code. Voters in colorado springs appear to have rejected changes to the citys sales tax designated for trails open space and parks known as tops.

Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. Did South Dakota v. The Colorado sales tax rate is currently.

However in the case of a mixed transaction that. 010 Trails Open Space and Parks TOPS 040 Public Safety Sales Tax PSST 057 2C. The Colorado Springs sales tax rate is.

With local taxes the total sales tax rate is between 2900 and 11200. The colorado springs sales tax rate is 307. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is 86.

The Colorado sales tax rate is 29 the sales. The Colorado state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local sales tax. The Pagosa Springs sales tax rate is. The Colorado state sales tax rate is currently.

On July 12 2021 the City of Colorado Springs Sales Tax Office will be transitioning to a new online licensing and tax filing system powered by MUNIRevs. In general the tax does not apply to sales of services except for those services specifically taxed by law. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. The El Paso County sales tax rate is. On July 12 2021 the City of Colorado Springs Sales Tax Office will be transitioning to a new online licensing and tax filing system powered by MUNIRevs.

For tax rates in other cities see Colorado sales taxes by city and county. What is the sales tax rate in Glenwood Springs Colorado. Method to calculate Colorado Springs sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The County sales tax rate is 1. Colorado has recent rate changes Fri Jan 01 2021. The Colorado Springs sales tax rate is.

The combined amount is 820 broken out as follows. Colorado Sales Tax 1 Revised August 2021 Colorado imposes sales tax on retail sales of tangible personal property. The minimum combined 2022 sales tax rate for El Paso County Colorado is.

The minimum combined 2021 sales tax rate for colorado springs colorado is 82. 1 2021 the new City of Colorado Springs sales and use tax rate will be 307 for all transactions occurring on or after that date. This is the total of state county and city sales tax rates.

The Colorado sales tax rate is currently 29. 307 City of Colorado Springs self-collected 200 General Fund. The December 2020 total local sales tax rate was 8250.

The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. You can print a 82 sales tax table here. Footnotes for County and Special District Tax.

How To Calculate Sales Tax Definition Formula Example

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Florida Sales Tax Rates By City County 2022

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Sales Tax Information Colorado Springs

Gross Receipts Location Code And Tax Rate Map Governments

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Arizona Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City County 2022

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Woocommerce Sales Tax In The Us How To Automate Calculations

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Montana Sales Tax Rates By City County 2022

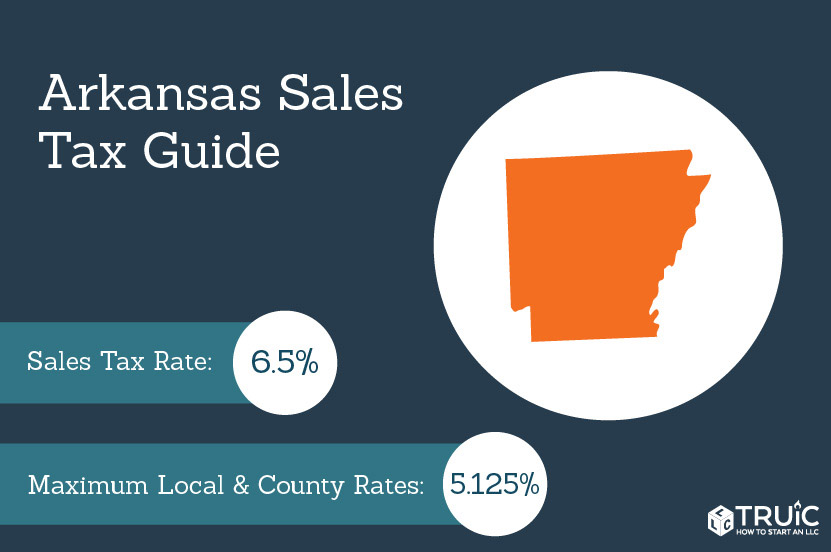

Arkansas Sales Tax Small Business Guide Truic

20 Unit Rental Property Template Customizable Microsoft Etsy In 2021 Budget Spreadsheet Rental Property Being A Landlord